Services

Credit Policy

Credit Policy →

Underwriting Rules

Underwriting rules are the roadmap to approval for the underwriting teams. MCA Risk Managers will develop systemic underwriting rules derived from multiple data sources, customized to your targeted credit tier, incorporating best in class industry knowledge. MCA Risk Managers specializes in teaming with our preferred partners on getting all rules coded into an auto decision tool.

Credit Policy

MCA Risk Managers specializes in developing written MCA Advance/Lender credit policy documents The Credit Policy documents are the operating instructions for any company providing capital to small businesses The Credit Policy can be shared with your provider of capital and be incorporated into a lending agreement

Offer/Pricing Strategy

Offer Strategy and Pricing

MCA Risk Managers will develop offer and pricing strategies based on your business customer base and business thresholds using multifactor data elements. Examples of data used include time in business, gross sales, credit scores, credit attributes, banking information and current advance payment information

Advance Calculator

MCA Risk Managers will create a calculator that returns factor, offer amount, duration and expected payment (daily or weekly) Calculators can be an excel spreadsheet or MCA Risk Managers can team with preferred partners to code the offers algorithms into a Loan Origination platform

← Offer/Pricing Strategy

Data Source Evaluation

Data Source

Evaluation →

MCA Risk Managers will evaluate and recommend the best tools including

- Credit Scores

- IBV

- ID verification

- Alternative Data

All data tools will be translated into custom data attributes including items such as

- Number of MCA Advances

- Total credit bureau trades

- Total unsecured installment payments

Advanced Analytics – Segmentation and Credit Scoring

Advanced Analytics – Segmentation and Credit Scoring

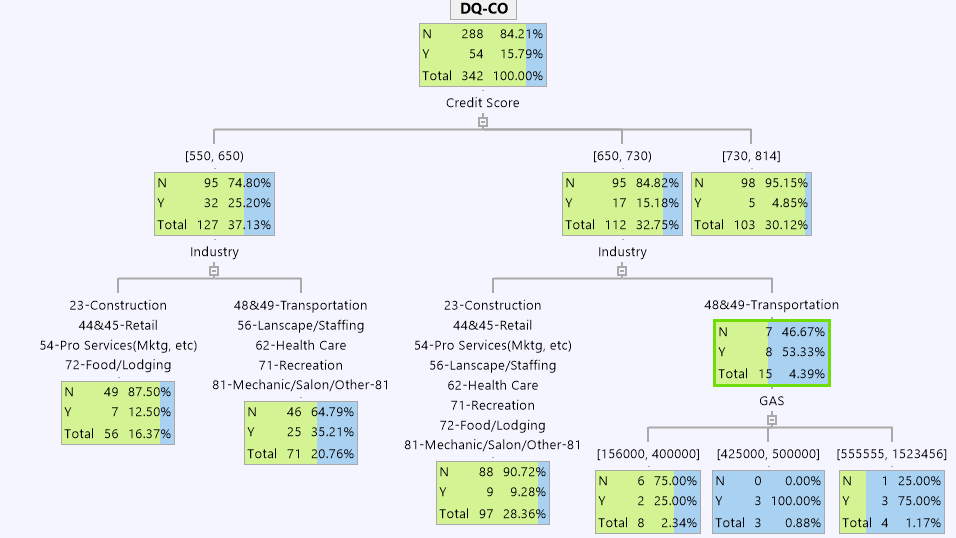

MCA Risk Managers can perform in-depth analytics to further optimize your business strategy including archive analyses, new score development and pricing optimization

All information will be placed into AI based decision tree software to develop credit risk segments and approval rules

In addition, Post-Funding Account Reviews will analyze top profit and top loss accounts, providing insights for future strategies.

Reporting Development

Acquisition and Approval

MCA Risk Managers will develop custom standard reporting for your business.

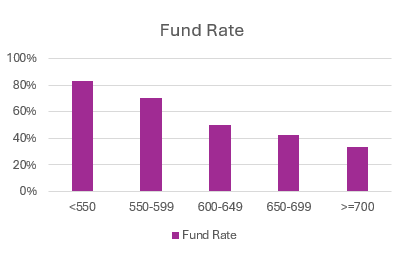

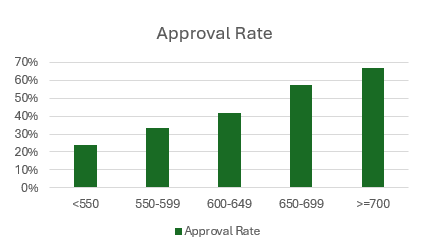

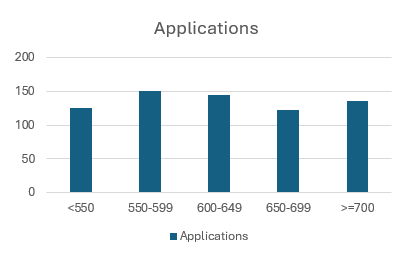

We will develop reporting so you can understand

- Who is applying?

- Who is being approved?

- Who is funding?

- What offer/terms is being accepted?

- What leads are working the best?

For example, reports can be developed by credit score (shown below), industry, risk tier, time in business, or any valuable segmentation attribute

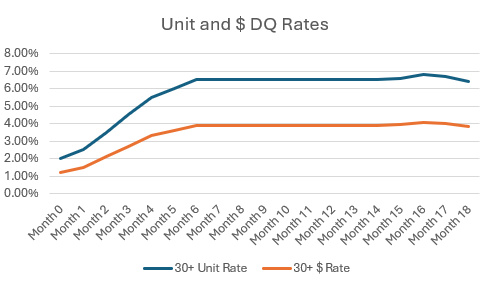

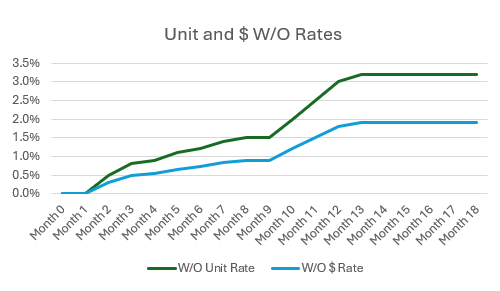

Delinquency

MCA industry has a difficult time reporting delinquency due to the fact that the FRPSA contract allows a customer with reduced sales to have lower payments

MCA Risk Managers has created a “standard days past due” measure that is based on contract expected performance

Delinquency and Write-off rates will be consistent, easily audited, and allow for accurate reserve calculations

Credit Vendor Management

Credit Vendor Management

There is no consolidated group of credit tools needed to effectively underwrite a small business advance

We assist in selecting the right credit risk tools, including:

- Credit bureaus – Business Principal Reports (Personal) and Business Credit Reports

- Scores – Credit Risk, Bankruptcy, Fraud

- IBV and bank attributes

- Secretary of State data

- Background and criminal reports

- ID Verification

- Alternative Data

MCA Risk Managers will develop relationships with all data vendors thereby assisting our clients in receiving the best pricing and service as well as work with its preferred partners to assist you in negotiating the best terms with all potential vendors

Collections Strategy

Collections Strategy

MCA Risk Managers can interface with collections servicers to ensure efficient management of delinquent accounts and attend Collection vendor calls with your leadership to make sure that your placed accounts are receiving appropriate attention

MCA Risk Managers will create and monitor A/B tests of competing Collection and Legal firms and make sure that each firm receives similar delinquent accounts for monitoring

The MCA Collections DPD calculation will allow for goals to be properly set with your Collection vendors

Preferred Partners

Cloud Maven is the leader in developing SalesForce based solutions for the MCA industry. Cloud Maven’s Credit Checker, OFAC Checker, Criminal Checker, Bank Connect, and Decision Rule Engine provides connections to credit bureaus, background services, SOS listings, and instant bank verification.

MCA Risk Managers works with Cloud Maven to implement you credit policy and maintain your credit policy on the platform.

DataTools is a leader in financial data storage and creating data transparency. DataTools stores SalesForce based data in a cloud-based data lake to assist Direct Mail Response modeling, Sales Funnel reports, Collection Analytics

Simple storage assists in any audit of your customer database.

Credit Platform Maintenance

Credit Platform Maintenance →

When working with MCA Risk Managers’ preferred vendors credit changes and data request will be managed by us

Simple storage assists in any audit of your customer database.

Credit Policy

- Change in credit approval rules

- Changes in credit risk tiers

- Changes in the advance calculator

- Introduction of new tools and information

Data Storage and Sharing

- New fields in the customer data platform

- Portfolio debt sale files

- Lender audit files